FACT SHEET REGARDING THE OBC BANK FRAUD

Prepared by K M Thomas, 16 year long current a/c holder, before requesting the bank manager on June 26,2018 to close the a/c

- Between November 2016 & March 2018, the Oriental Bank of Commerce (OBC), Kilpauk branch had released 63 payments from the current a/c (10651010010670) of the Harrington Post News Weekly to Just Dial Limited (JDL) based on time barred and cancelled documents that I had signed in August 2013.

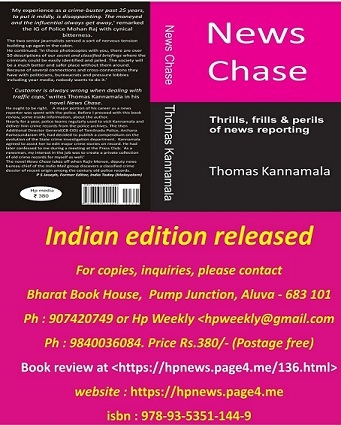

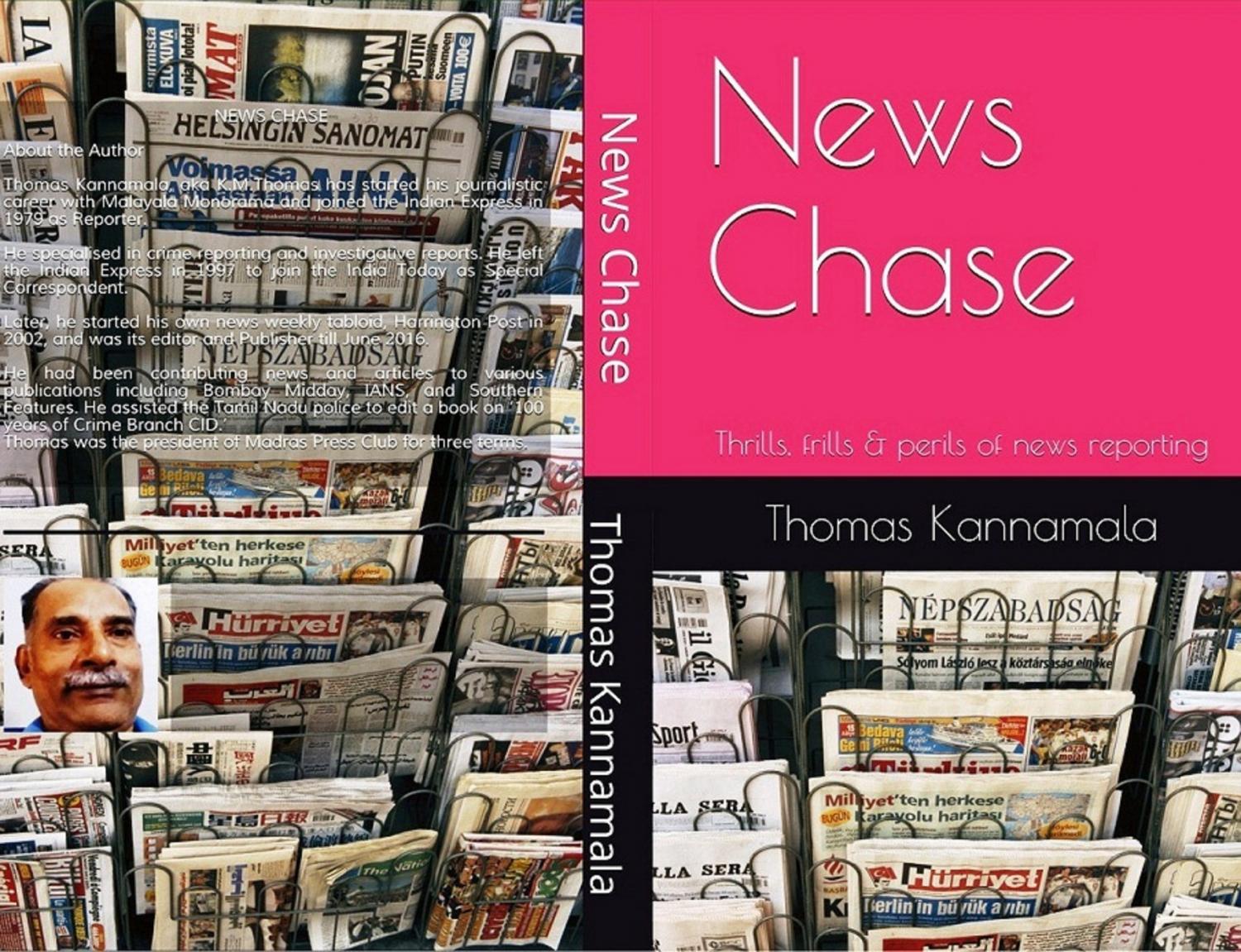

- Harrington Post is a news weekly registered by the Registrar of Newspapers for India in 2002 (TNENG/2002/7652). I, K M Thomas, am its Editor and Publisher. I am the only authorised signatory of this account.

- Although the OBC had illegally released Rs.14, 390/- in 63 instalments, I did not receive a single communication, SMS or email from the bank during this entire period 26 months about these transactions. There was no change in my email id, and the cell phone numbers given at the bank, though I shifted my residence from Chennai to Kerala.

- After several rounds of discussions with the Bank manager, he forwarded me the invalid documents on which the payments were released.

I orally requested the manager to file a criminal case against the Just Dial Limited, which was the apparent beneficiary of the fraud.

But nothing happened.

On February 2018, I sent an email to the Manager, OBC, Kilpauk Branch, Chennai 600010, requesting him to file a criminal complaint against Just Dial for their fraudulent action.

I wrote this email, because when I brought this matter to the notice of the higher ups in the OBC, its Nodal Officer sent a reply on Feb.25, 2018 which said the Manager had spoken to the complainant (me) and the `file is closed.'

The bank has successfully `closed’ a banking fraud involving over Rs.14,000/- that continued for nearly two years, with just a phone call by the manager!

Meantime, probably fearing legal action, and Facebook messages to Amitabh Bachen, their brand ambassador, the Just Dial Limited telephoned me, and volunteered to return the money. I agreed. They credited Rs 14,390/-to my personal a/c on March 26, 2018. They had fraudulently withdrawn the money, using fake document as genuine, according to my reckoning. Possibly with the connivance of the bank.

The JDL had returned the money, after I had detected the fraud.

But the charges of breach of trust, negligence, misappropriation of funds, falsification of accounts, possible collusion, causing financial loss to a customer and wrongful gain to a third party continue to exist.

This sordid episode had caused me loss of money, time, and tremendous mental distress.

So I requested the Bank manager in writing to lodge a complaint with the police, because of the casual manner in which the Bank dealt with this issue.

However, when I checked with the Manager later, he said my request for police complaint had been sent to the Bank's legal department.

If my complaint is frivolous, the bank could have sent me a reply in writing accordingly. If they had admitted their lapses in the beginning itself, and sent an apology letter, agreeing to restore the earlier bank balance, that would have been the end of the matter.

As no such thing was happening, I sent a complaint to the Bank's Ombudsman. His reply to me received on June 23, 2018, surprisingly did not touch on the criminality involved.

The Ombudsman had completely missed the main points. Nowhere in my petitions, I had asked the bank to return the money which the bank had (illegally) recovered stating `I failed to maintain minimum balance’. I had just pointed it out to him that the balance went below the minimum level, to emphasis the fact the criminal negligence/collusion of the Bank in releasing my money illegally to a third party had led to such a situation.

Copy of the Ombudsman’s letter to me:-

" Sir/Madam

Complaint No. 201718006010036

Please refer to your captioned complaint.

It is observed that you have complained against the bank regarding charges levied for non-maintenance of minimum balance on account of reported fraud in your company's account. Since the matter is beyond the purview of the Banking Ombudsman Scheme, 2006, your complaint has been treated as dealt with and closed under Clause 13(a) of the Banking Ombudsman Scheme, 2006. The clause reads as under:

Clause 13(a) of the Banking Ombudsman Scheme, 2006 "The Banking Ombudsman may reject a complaint at any stage if it appears to him that the complaint made is not on the grounds of complaint referred to in clause 8" As per Clause 14(1) of the Banking Ombudsman Scheme, 2006, a complaint which is rejected under Clause 13(a) is non-appealable. However, you are free to approach any other grievance redressal forum, as you deem fit, to redress your complaint.

This is issued as per orders of the Banking Ombudsman.

Yours faithfully, sd/-Assistant General Manager?

As the bank has maintained a defiant attitude without touching the misappropriation part, I am now more interested in bringing the criminals to the book, even ignoring the loss and distress I had suffered.

I will be grateful, if any of the readers visiting this page can suggest a suitable course of action.

Email : hpweekly@gmail.com

The readers write

============

From Annathambi S <annanthambi@mail.com>

Shocking. Thank you for publishing details about the OBC Bank Fraud. It is extremely disturbing to see how a Nationalised Bank can indulge in such a criminal act, and treat a senior citizen who brought it to light this manner. The facts in your news report raise many a concern and questions. I would like you to know that you are not alone and request you take this matter to the highest level to expose and prosecute such fraudulent collusion between banks and private entities to skim hard earned money from trusting bank depositors.

Let me share some of my concerns with you.

This fraud is similar to the PNB scam. The only difference is that instead of losing the money for the bank (from it's P&L), this scam is diversion of money from a media company account to the corporate account. Also we need to remember that the bank in question (OBC) chose to take over another scam tainted bank, raising questions on the very DNA propensity of the bank in question.

Some of the suspicious activities noted in your report are:

- Paying money to a private entity in spite of a cancelled request

(acknowledged by the bank 2 years ago).

Sounds familiar to the LOU scam?

- A dormant bank account targeted, and justifications created when the fraud has been detected.

- SMS alert and email statement suppressed without customer consent makes it appear like collusion.

Sounds familiar to another PSB fraud?

This also raises a question on the quality of bank auditing?

How come the highly paid `bank auditors’ did not find it during the two years?

How many of the 2500 plus branches of OBC have such cases of fraud happening?

I assure you that ordinary citizens such as myself support you in your effort to expose such a huge fraud happening in the banking industry. This calls for immediate intervention by RBI and the Finance Ministry and calls for an enquiry at the highest level and audits at branch and employee level to see who all are involved and to what extent.

I request you to publish in your website further developments in this case, including reactions, if any, from the OBC,RBI, Finance Ministry and other authorities to see if the so called watch dogs really walk the talk.

Anna Thambi, Mumbai

|   | |||

Your are lucky. After reading your first-hand experience with the Oriental Bank of Commerce, I have come to the conclusion that it is a common occurrence in many other banks. The concerned officials protect their back citing several rules and regulations which make you feel that in fact you are guilty. I am specifically not mentioning the name of the bank in my case, as I continue to do business with the same bank, and decided not to close the account.

The alternate bank could be perhaps worse.

In my case, I had Rs 62,4000/- balance in my account, and I issued a cheque to a supplier for Rs.22,000. It bounced.

I came to know of it when the next consignment of electronic items did not come from a Jullundur based dealer, a week later. When I telephoned him, his first words were

`Mr Subbu, are you aware that I could file a civil and criminal case against you.’

I thought he was joking and said I knew he was a very influential person, and could anything against ordinary businessman like me.

Probably sensing my innocence, he told me that my Rs.22K cheque had bounced.

I was shocked and said I would E transfer the money to his a/c immediately.

Then he told me that probably it could be a banker’s mistake, and this could lead to financial loss by way of fines, and my CIBIL rating also could go down.

Later, I found out that the bank had wrongly credited a my remittance to another a/c. The Manager with a straight face blamed me for not having checked the bank’s website, and brought it the bank’s notice before issuing the Rs.22 K cheque. `It is your duty to ensure that you have sufficient funds before issuing a cheque, according to rules.’

As to the Rs.350/- the bank had deducted towards cheque bounce charges, the manager said `the computer does it, and he was unable to do anything about it.’

So, sir. I would say you are lucky that you did not issue any cheque during the two year period to invite the wrath and ridicule of some third parties, because of the OBC committed fraud.

Background of the case:

* My last transaction with the OBC, before detection of the fraud was on June 04, 2016. After June 2016, I was not in Chennai most of the time. I detected the fraud on January 28, 2018, when I sought our a/c statement from the OBC.

* Our further inquiries with the OBC revealed that the funds were misappropriated on the basis of two invalid documents – a mandate form signed by me on October 2013, and a cancelled OBC cheque attached to it for signature verification.

* The OBC had released Rs.1250 ECS every month from November 2013, based on this 12 MONTHS CONTRACT.

* We CANCELLED this contract, and stopped further ECS payments to JDL from July 2014, as JDL service was unsatisfactory.

This cancellation was accepted in writing by the OBC and JDL in 2014.

* The JDL had produced the same cancelled and invalid documents 27 months later, in October 2016, and the OBC, for reasons only known to them, accepted it, and started releasing payments from November 2016.

* We were kept in the dark about these illegal dealings, till we detected it in January this year. Normally, I used to get an SMS after every transaction, and an email of my monthly statements. It is mysterious why the bank chose to remain quiet about these 63 payments over 810 days. When I checked with the Manager, he said :-

- a) no intimation is sent to the customer for transactions below Rs.1000/-

- b) Stopped emailing monthly statements, as customers have the facility to access the bank’s website. (I could not access the website with the password that the OBC supplied, and this was already brought to the notice of the bank. Incidentally, how many senior citizens could do this?)

* I feel that this is a fit case for criminal action against the OBC and JPL, for embezzlement of funds, breach of trust, using a fake document as genuine, cheating, causing financial loss to a customer, and facilitating financial gains to the Bank and Just Dial Limited.

PS : On June 06, 2016, the OBC made 47 recoveries totalling Rs.2793 from Harrington Post a/c for not maintaining minimum balance.

Though the misappropriation was brought to the bank’s notice in January 2018 itself, the bank delayed a honourable settlement till now, and continued to recover `minimum balance’ penalty, impoverishing me further.

The questionable services that the OBC rendered to Just Dial had depleted our balance below Rs.5000, helping the OBC to appropriate our funds further for `not maintaining minimum balance.’

This bank has successfully reduced our balance amount from Rs.20,565 on June 06, 2016 to Rs 745 as on June 09, 2018. To avoid their further `customer service’, I had asked the bank on June 26,2018 to close our accounts. Trust they would do it at least before exhausting Rs.745 with further service.

KM Thomas

hpweekly@gmail.com

Report this site as abusive Login